Growth Watchlist: 5 Brands in Decline, feb. 2026

It’s only February. It’s freezing across much of the U.S. And yet consumers are already planning ahead for warmer getaways, more time outdoors, and summer routines.

That context matters. Because while intent and category demand are clearly rising, several iconic brands are quietly losing users inside categories that are growing—or outright booming. That contradiction is the signal CMOs should pay attention to.

This month’s Growth Watchlist looks at five brands where decline isn’t being caused by a shrinking market, but by confidence erosion, relevance drift, and unresolved friction. In each case, the warning signs appeared well before users disappeared. If you missed last month’s report, find it HERE.

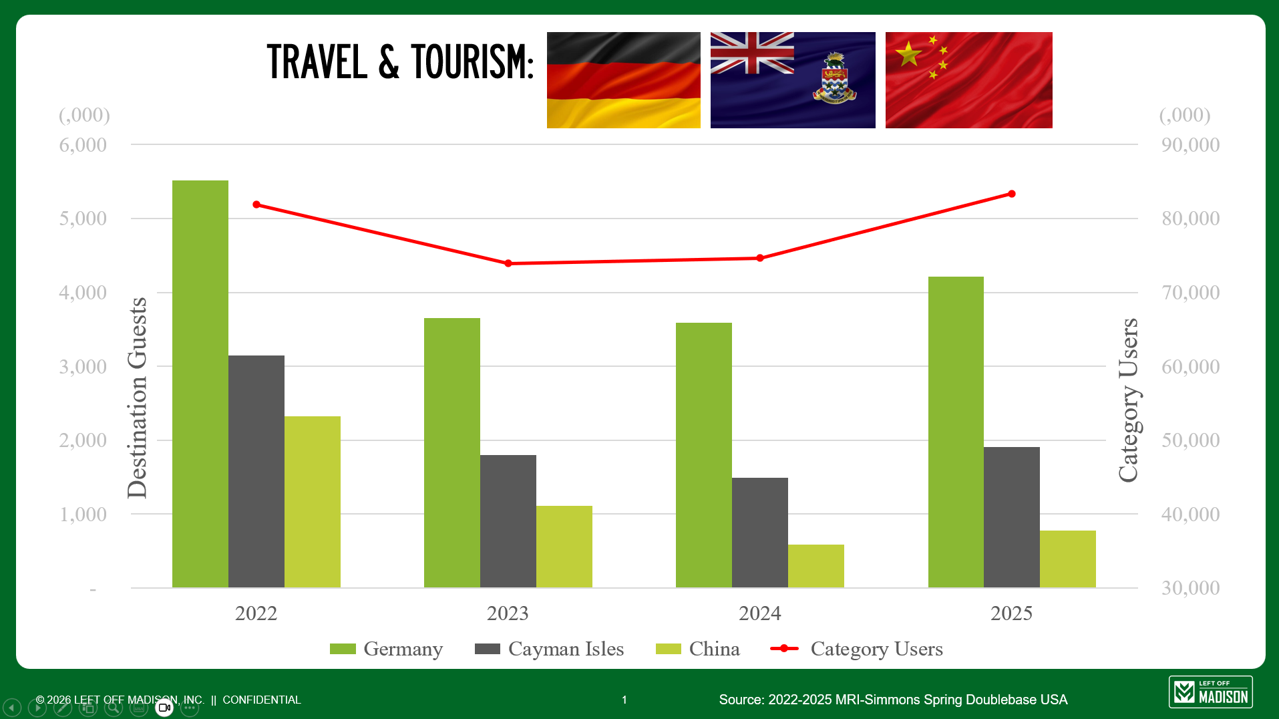

#1 — Travel Destinations in Decline

(Special Edition)

As detailed in our February Travel Supplement, U.S. outbound travel is up—yet several destinations are sharply down versus 2022.

China, Germany, the Cayman Islands, Australia/New Zealand, and Central America all lost meaningful numbers of U.S.-based travelers during the same period that Mexico, the Bahamas, and the Dominican Republic surged.

Why? Across declining destinations, we see the same drivers:

Perceived friction (visa complexity, distance, cost, uncertainty)

Confidence gaps fueled by media narratives or lack of proactive reassurance

Stagnant storytelling that relies on legacy appeal while competitors modernize

When travelers feel unsure, they default to destinations that feel easier to choose.

Left Off Madison POV:

In growth categories, brands don’t lose because demand disappears. They lose because someone else removes doubt faster.

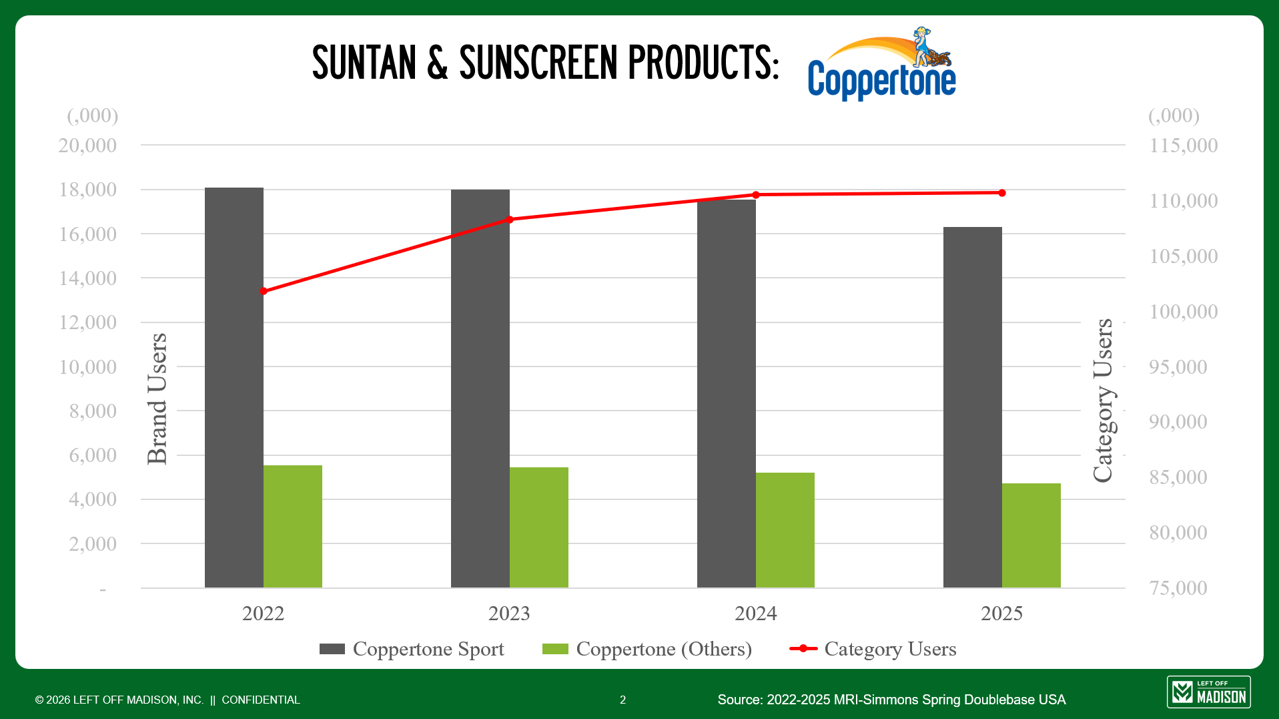

#2 — SUNTAN & sUNSCREEN pRODUCTS

Skin care in the sun should be Coppertone’s moment.

Since 2022, the category added nearly 9 million new users (+9%), with heavy users up 21%. Yet Coppertone— under Beiersdorf— is losing ground:

Coppertone Sport: –10% (–1.7M users)

Core Coppertone lines: –15% (–800K users)

Why is this happening?

The category has shifted from sun protection to skin health

Ingredient scrutiny and dermatologist credibility now drive trial

Newer brands signal science, safety, and modern routines more clearly

Meanwhile, CeraVe, Banana Boat, and Banana Boat Sport are winning by aligning with these expectations.

Left Off Madison POV:

In health-adjacent categories, nostalgia fades fast. Trust, clarity, and modern proof points now outweigh “drafting” in your legacy or remaking the iconic imagery.

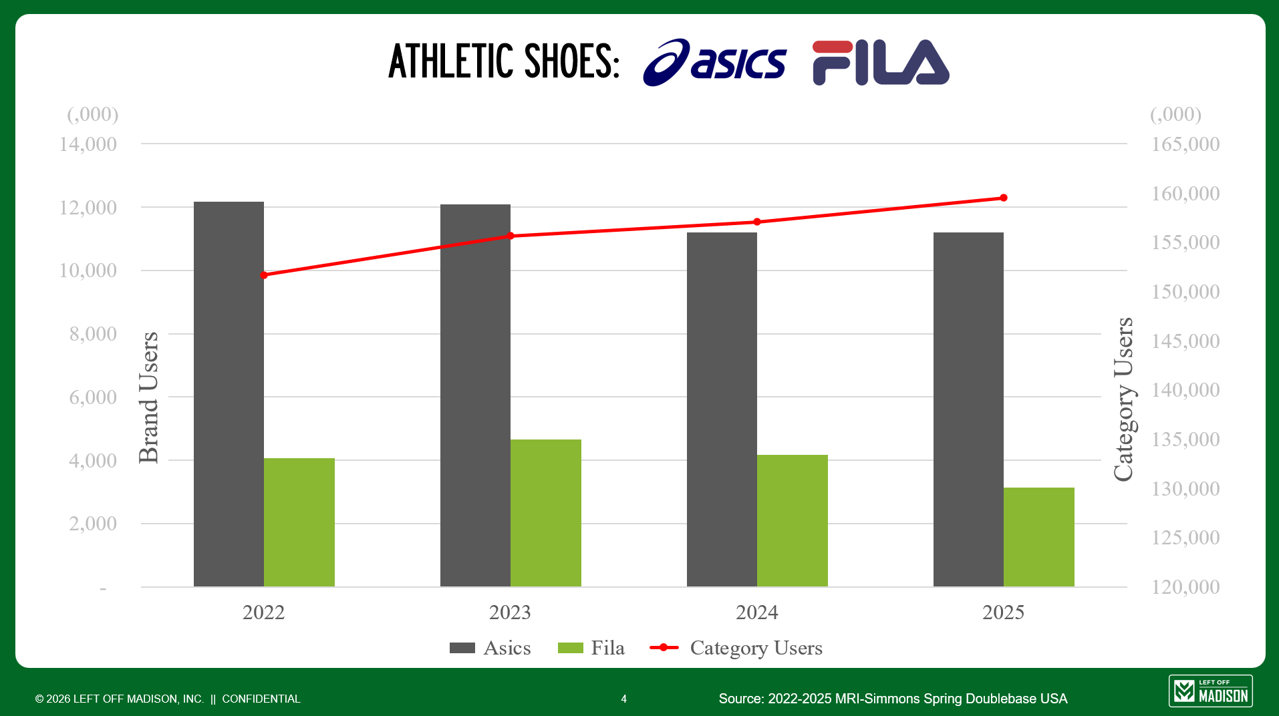

#3 — ATHELTIC FOOTWEAR

Athletic footwear is thriving.

Nearly 8 million more adults (+5%) are buying athletic shoes today than in 2022. Heavy buyers (3+ pairs/year) are up 11%.

Yet ASICS (–8%) and FILA (–23%) are both losing nearly 1 million users each.

What’s driving the erosion?

Performance claims have become table stakes

Culture, identity, and community now influence choice as much as function

Competitors are clearer about who they’re for and why now

Brands like Jordan Brand, Brooks, and Skechers are winning by pairing product with purpose, story, and cultural momentum.

Left Off Madison POV:

In growth categories, silence is a strategy—and rarely a winning one. Brands that stop showing up stop being chosen.

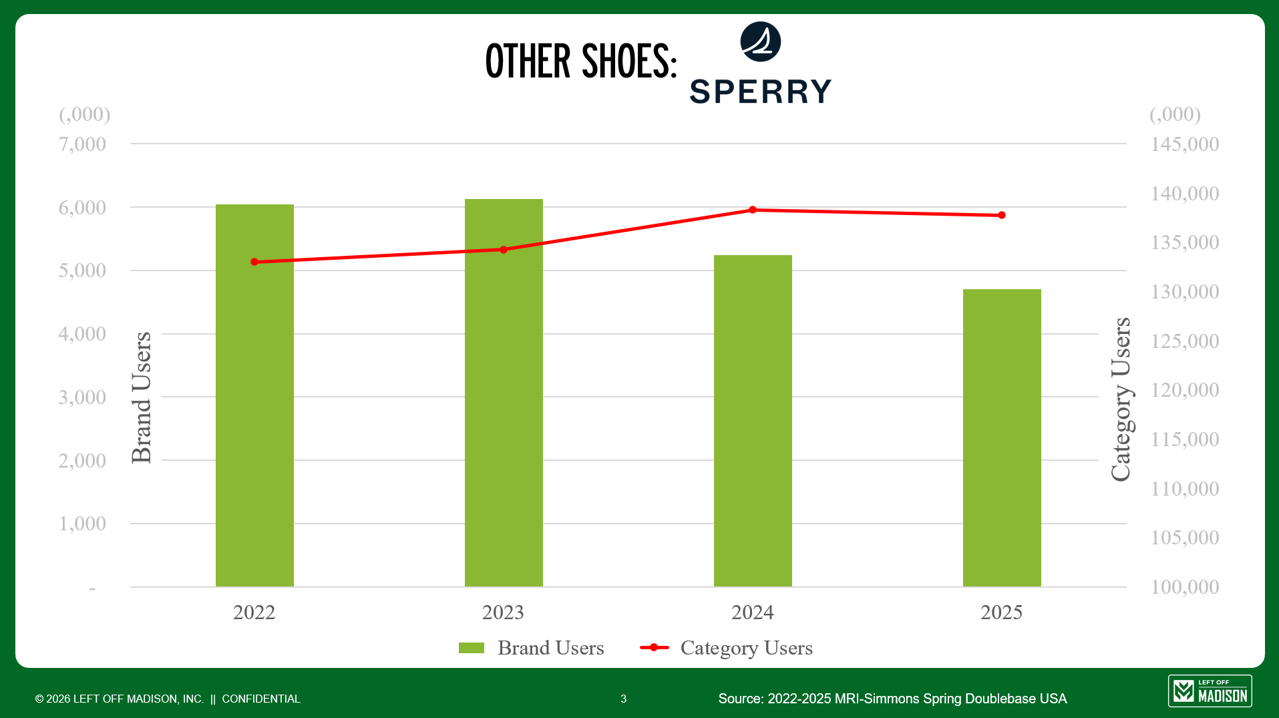

#4 — OTHER SHOES

Sperry’s decline is especially telling.

Despite being synonymous with summer, the brand is down 22% (–1.3M users) under Authentic Brands Group, while the category added 4.7 million new buyers (+4%).

What likely went wrong?

Minimal visible innovation in silhouette or usage occasions

Limited cultural presence or collaboration strategy

Failure to reframe boat shoes for modern lifestyles

Meanwhile, Crocs (+63%) and UGG (+25%) aggressively expanded relevance through comfort, culture, and collaboration.

Left Off Madison POV:

Seasonal brands don’t get a pass for inactivity. If you don’t redefine yourself, the category will redefine you out.

#5 — QSR / FAST FOOD

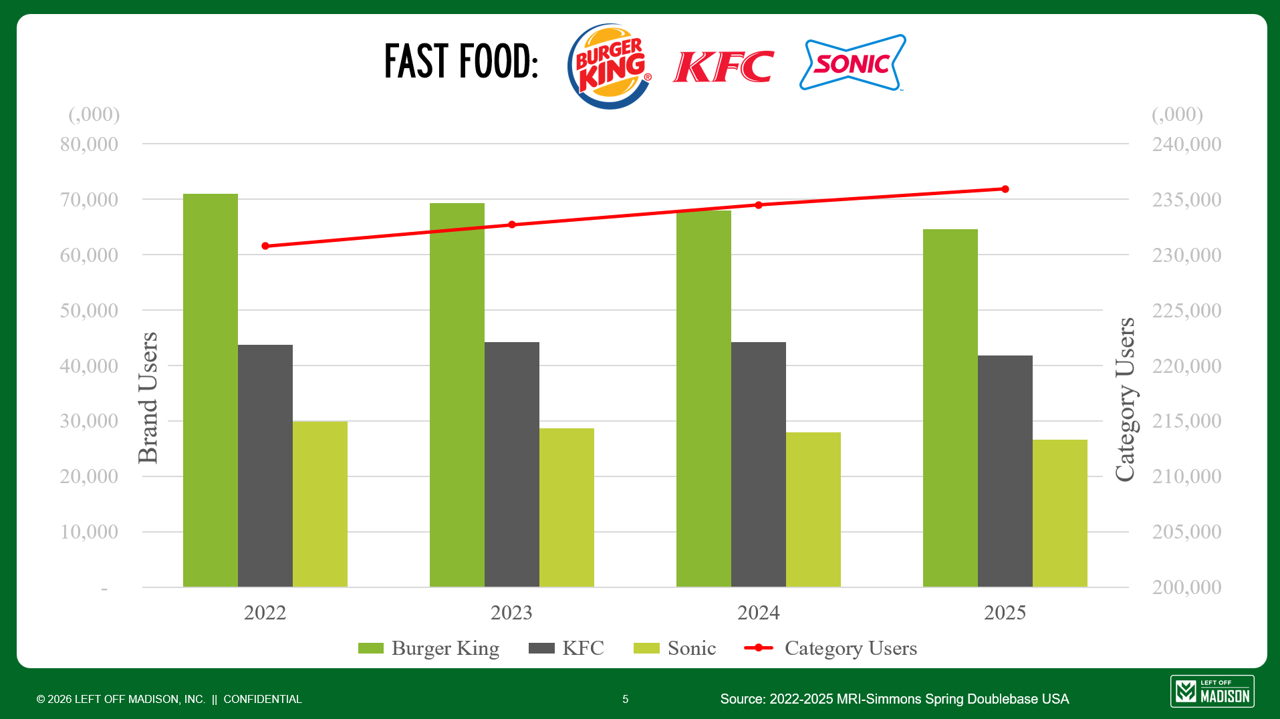

Fast food is still growing—but not evenly.

Since 2022, the category added 5 million users (+2%), with heavy users up 3%. Yet several legacy brands are losing millions of guests.

Why?

Menus lack clear news or differentiated value

Promotions don’t ladder to desire or distinctiveness

Brand meaning has eroded while competitors modernize

KFC is a personal example for us. Years ago, while revitalizing 7UP, our team— including Bee Nguyen and Côme Chantrel— uncovered a powerful insight: urban myths questioning whether KFC served “real chicken” were going unaddressed. Even more troubling, the word “chicken” did not appear in-store or on menus.

A few pointed changes helped stores rebound back then.

Left Off Madison POV:

When brands don’t actively manage perception, culture fills the gap and rarely in your favor.

The Pattern CMOs Should Sit With

Across every brand this month, the same forces are at work:

Demand is present

The category is growing

But relevance is unevenly earned

Decline doesn’t begin with sales. It begins with unanswered questions in the consumer’s mind.

The Growth Watchlist exists to surface those moments early while prevention is still possible and recovery doesn’t require reinvention.

If this feels familiar, that’s not coincidence. That’s the signal.

Ready for more? Explore some of our own brand revival case studies, HERE, that includes Hello Kitty, Cadillac, LUMIX camera, U.S. Army, and multiple beverages.