Growth Watchlist: 5 Travel Brands in Decline, FEB. 2026

Travel demand didn’t disappear. It grew.

U.S.-based outbound travel has increased since 2022. Heavy travelers are taking more trips. Yet several major destinations are quietly losing hundreds of thousands, sometimes millions, of American visitors.

That contradiction is the warning.

This month’s supplemental Growth Watchlist examines five destinations where decline is occurring inside growing travel demand. When the category is healthy and your brand is shrinking, the issue isn’t macro. It’s relevance, confidence, clarity, and surely a poor communication strategy and plan.

The goal of this series isn’t to shame. It’s to surface early signals many CMO can recognize, and act on before decline hardens into destiny.

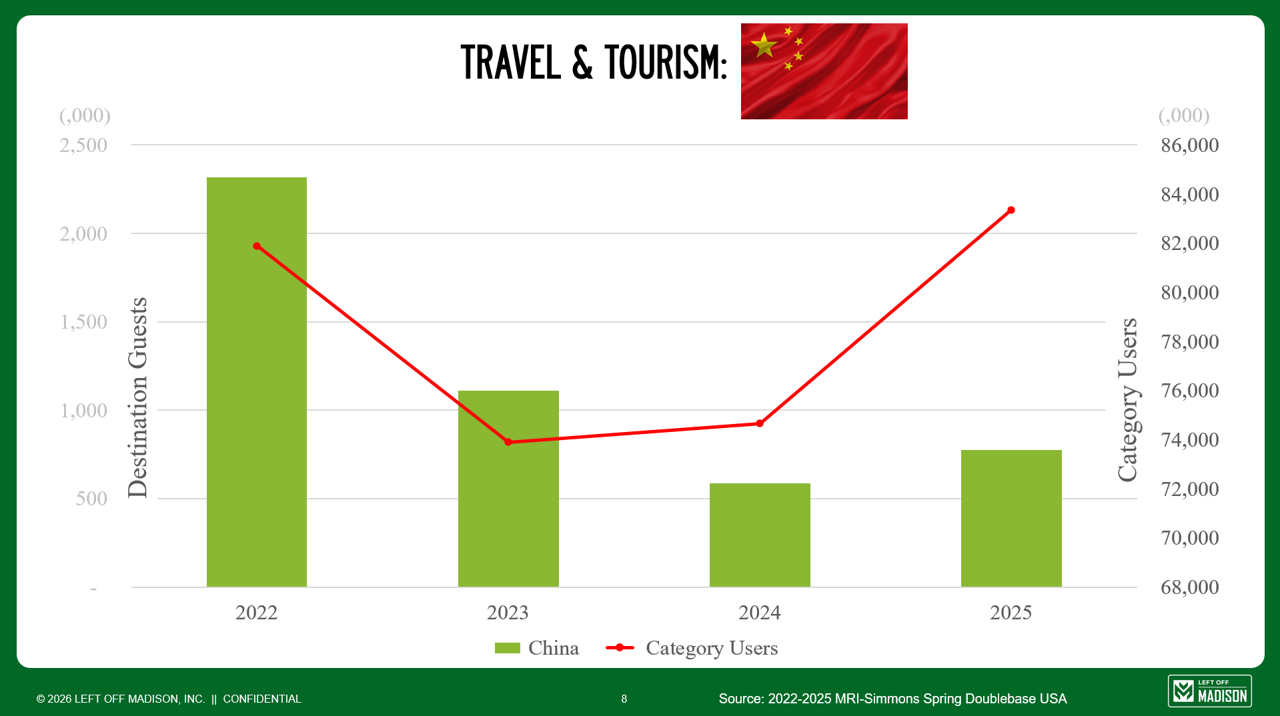

#1 — China

U.S. Travelers Down 67% vs. 2022 (–1.5M Visitors)

China leads this month’s Watchlist by a wide margin and for reasons that go far beyond tourism marketing.

Despite immense cultural appeal, U.S.-based travel to China has collapsed, down 67% since 2022. This decline is driven by perceived friction and fear: geopolitical tension, safety narratives, visa complexity, and relentless negative media framing.

When confidence collapses, intent never converts.

Left Off Madison POV:

Tourism brands don’t lose travelers first, they lose permission. Recovery here requires rebuilding trust, simplifying the journey, and proactively reshaping perception before competitors— or headlines— do it for you.

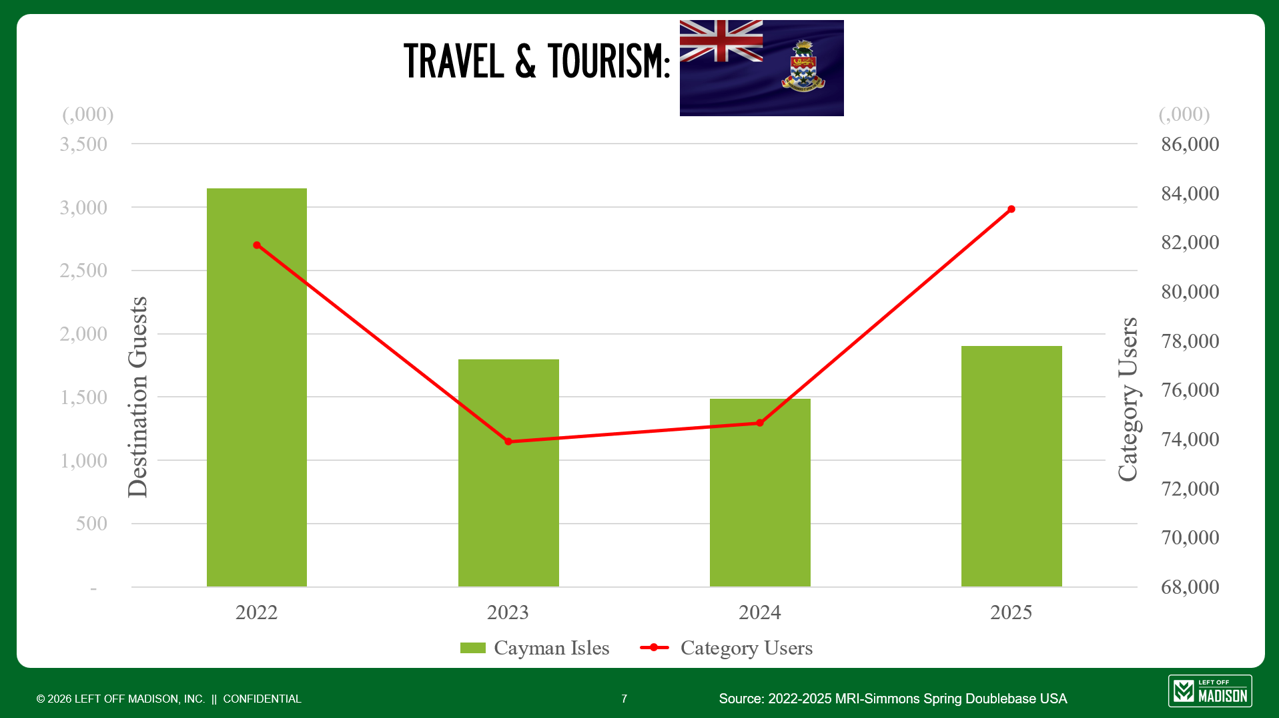

#2 — Cayman Islands

U.S. Travelers Down 40% vs. 2022 (–1.25M Visitors)

The Cayman Islands’ decline is a textbook premium-brand problem.

Down 40% since 2022, Cayman has lost nearly as many U.S. travelers as Germany, but without Germany’s scale or complexity. As other Caribbean destinations modernize, refresh their messaging, and balance indulgence with accessibility, Cayman risks being perceived as expensive, static, or interchangeable.

Left Off Madison POV:

In luxury travel, stagnation is decline. Premium brands aren’t punished for price. They’re punished for failing to signal progress.

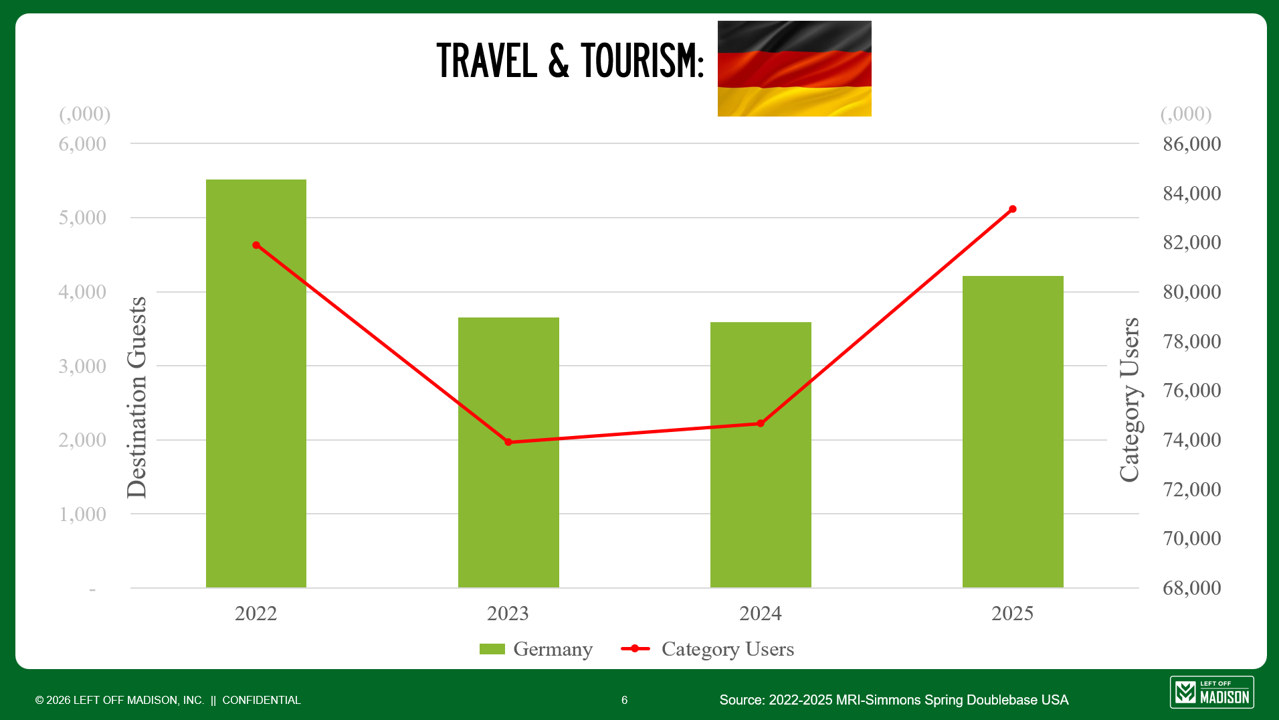

#3 — Germany

U.S. Travelers Down 24% vs. 2022 (–1.3M Visitors)

Germany’s loss is quieter, but no less instructive.

Down 24% since 2022, Germany hasn’t suffered from instability or access issues. Instead, it faces an emotional relevance challenge. In a European set dominated by aspirational storytelling and “can’t-miss” experiences, Germany risks being perceived as important, but not urgent.

Left Off Madison POV:

Awareness without emotional pull is indistinguishable from invisibility. Legacy reputation doesn’t replace inspiration.

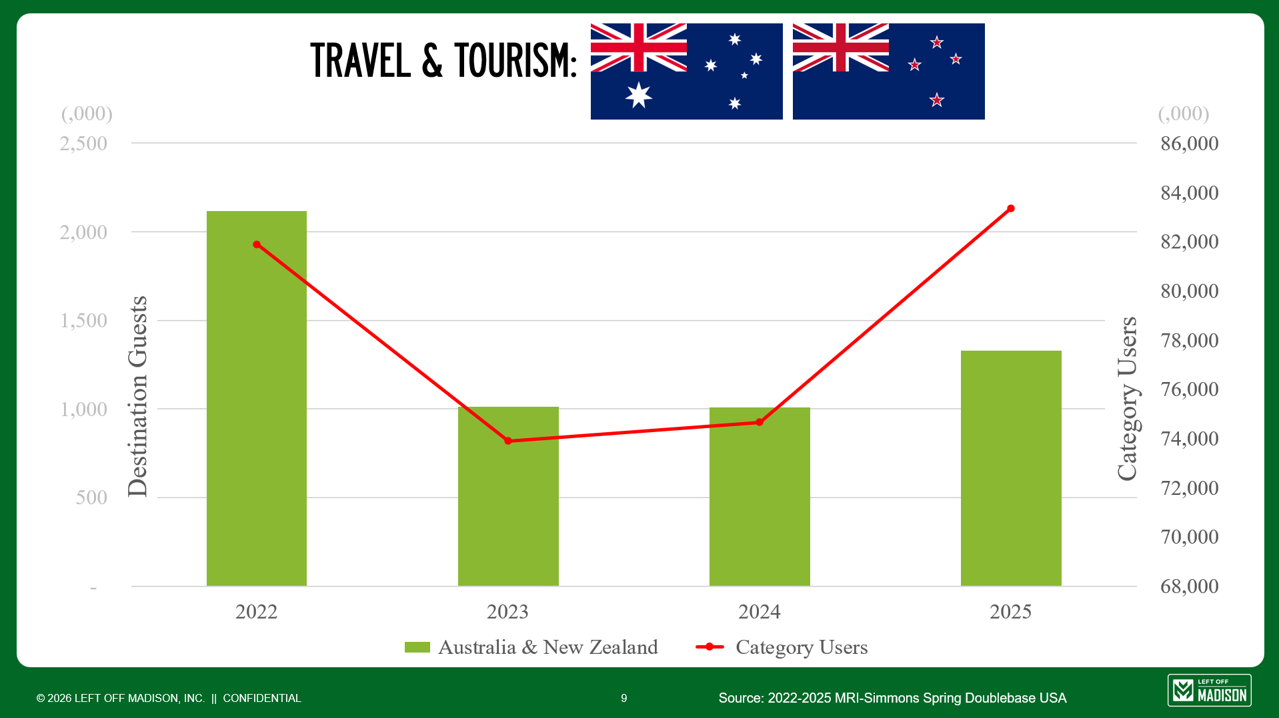

#4 — Australia / New Zealand

U.S. Travelers Down 18% vs. 2022 (–377,000 Visitors)

Long-haul travel is back, but not evenly.

Australia and New Zealand together are down 18% versus 2022, losing more than 377,000 U.S. travelers. Distance, cost, and time commitment raise the bar for motivation, and these destinations now compete not just with Europe, but with closer, easier, high-value alternatives.

Left Off Madison POV:

When friction is high, the story must work harder. Long-haul destinations can’t rely on bucket-list mythology alone. They must continuously re-earn urgency.

#5 — Central America

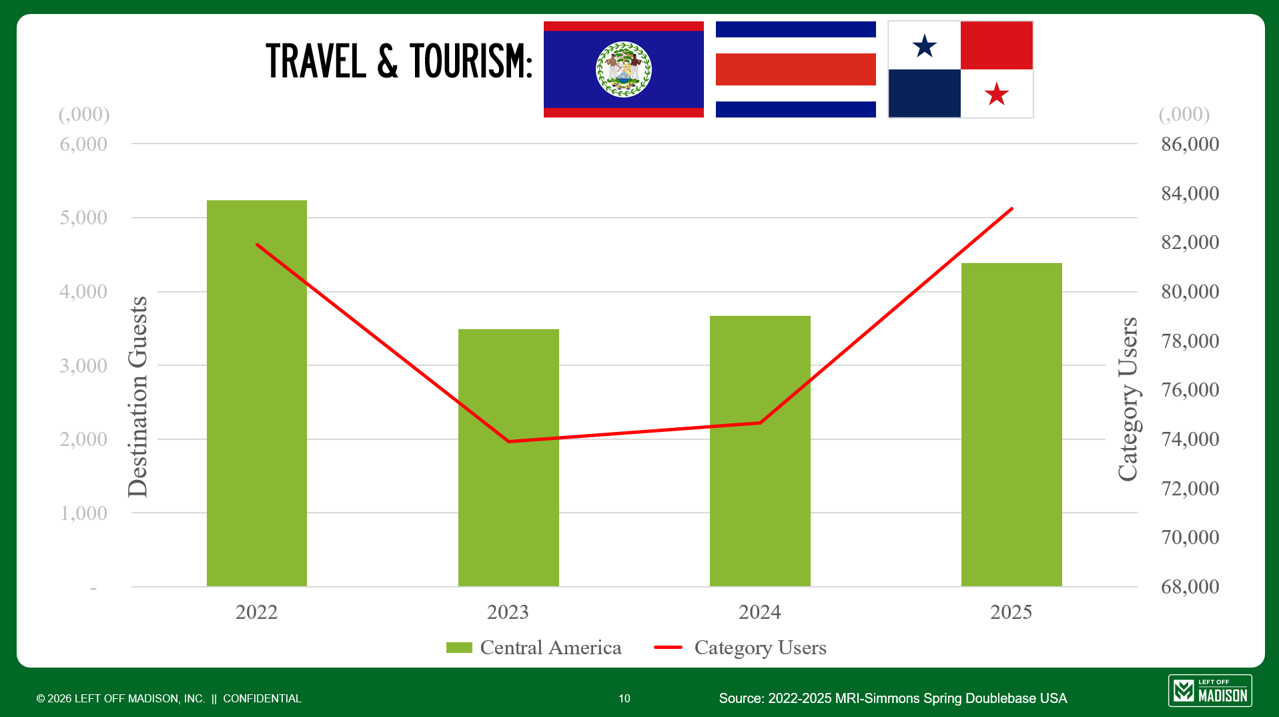

U.S. Travelers Down 16% vs. 2022 (–847,000 Visitors)

This one is a little personal to Left Off Madison.

Central America, as a region, is down 16% since 2022— nearly 850,000 lost U.S. travelers— despite growing interest in eco-tourism, adventure travel, and culturally immersive experiences.

The challenge isn’t product. It’s fragmentation.

Multiple countries. Multiple messages. Inconsistent investment. Uneven confidence cues.

And it’s close to our heart at Left Off Madison because we maintain a satellite office presence on Ambergris Caye in Belize that gives us a front-row seat to both the opportunity and the missed coordination holding the region back.

Left Off Madison POV:

Regions don’t compete unless they brand like one. Without a unifying narrative and coordinated confidence-building, growth flows to destinations that feel simpler and safer to choose.

The Contrast CMOs Can’t Ignore

While these destinations declined, others surged:

Turkey: +84% (+880K U.S. travelers)

Bahamas: +39% (+2.49M)

Dominican Republic: +37% (+1.87M)

Switzerland: +26% (+580K)

Canada: +20% (+1.78M)

Mexico: +9% (+1.89M)

These are just a few. This isn’t luck. These destinations invested in clarity, consistency, and confidence—reminding travelers why to choose them now.

The Pattern CMOs Should Recognize

Across all five declines, the same signals repeat:

Demand didn’t vanish—confidence did

Choice became complicated

The story stopped evolving

Brands don’t lose relevance overnight. They lose it while assuming they still have it.

There’s also a strong likelihood that these tourism boards have backed themselves into a weak communications strategy. We can’t know this with absolute certainty, but the signals and our experience suggest an overreliance on lower-funnel tactics such as paid search and remarketing, with little meaningful investment in upper-funnel advertising designed to spark dreaming, inspiration, and desire.

When destinations operate this way, the outcome is predictable: the prospect pool steadily shrinks while cost-per-acquisition rises. You end up fighting harder— and paying more— for fewer travelers, rather than creating new demand upstream. We’ve seen this movie before.

Since roughly 2014, Belize struggled with this exact imbalance, compounded by resorts making similar short-term decisions. Only recently— around late 2025— did the strategy begin to shift, with renewed upper-funnel investment in aspirational video and social content, followed by smarter remarketing of high-intent viewers into immersive planning and booking experiences.

The lesson is simple: without imagination at the top of the funnel, performance at the bottom eventually collapses.

A Final Thought

Most tourism boards won’t see this as a marketing problem. Until it becomes one.

The Growth Watchlist exists to surface early warning signs before decline becomes structural, before recovery requires reinvention, and before competitors define your destination for you.

If this feels uncomfortably familiar, that’s the point.

Ready for more? Explore some of our own travel and tourism case studies, HERE, that includes Meliá Hotels, Caesars Entertainment, Puerto Vallarta, and the 9/11 Museum to name a few.