The Growth Watchlist: 5 brands in decline, jan. 2026

Most brands don’t fail suddenly. They decline quietly.

One usage occasion at a time.

One lost cohort.

One forgotten reason to choose.

By the time revenue shows it, the hardest work is already behind them.

That’s why we created The Growth Watchlist.

Each month, we will use our data tools to surface five brands showing meaningful declines in real category usage over the past few years. Not market share. Not sentiment. Actual buyers, actually leaving.

This isn’t a ranking. It isn’t a prediction. And it isn’t criticism for sport. It’s an early-warning system.

In our experience, brand decline rarely starts with competition or price. It more often starts with relevance — with behavior shifts brands don’t see fast enough, and positioning that once worked, but may no longer.

This month’s Watchlist spans five very different categories: auto care, breakfast, fresh poultry, bottled water, and artificial sweeteners. On the surface, they share little. Under the data, they appear to share a set of familiar risk patterns.

Each shows early erosion that may be masked by distribution, promotion, or legacy equity — until recovery becomes exponentially harder.

This series exists to surface those patterns early. Before decline becomes destiny.

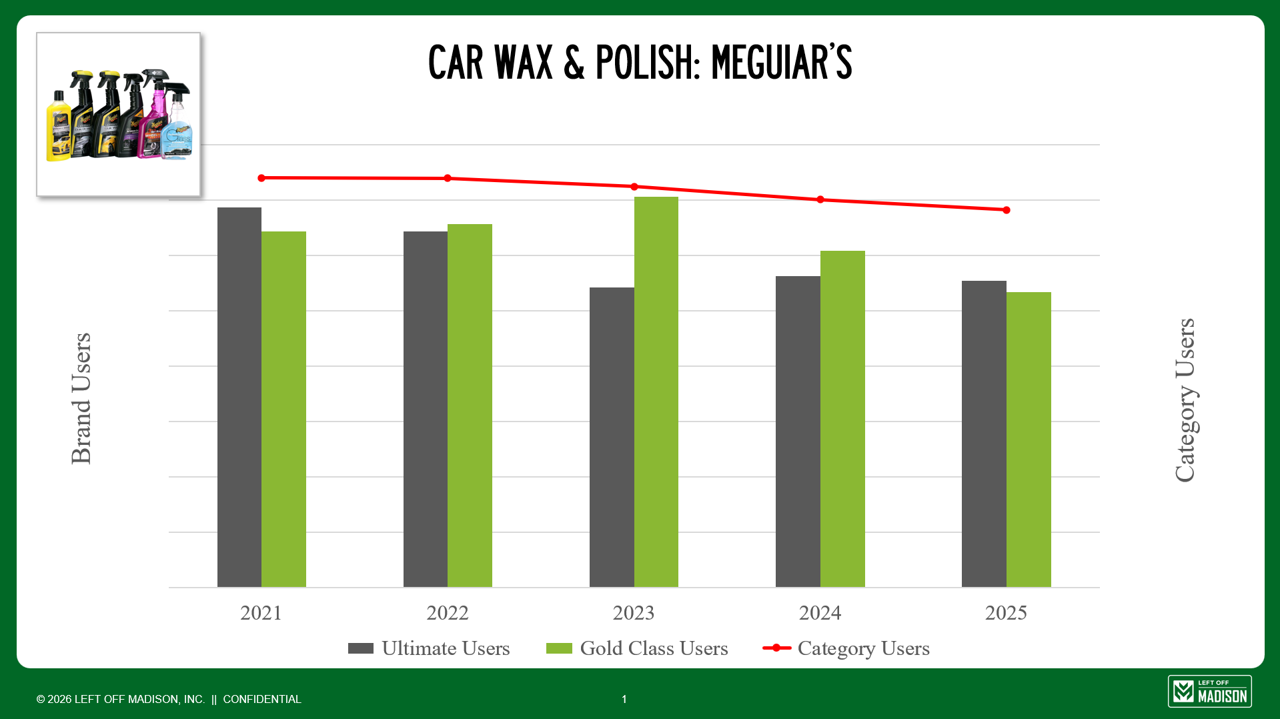

CAR WAX & POLISH: MEGUIAR’S

Meguiar’s Ultimate users: –19%

Meguiar’s Gold Class users: –17%

Category users: –8%

Heavy users: +15%

Fewer people are waxing cars overall, but enthusiasts are doing more, not less — and Meguiar’s is losing inside that growing core. Have you shopped the shelves at retail? It’s a sea of similar brands with shoppers clinging onto outdated perceptions about the brands. Or, they have no idea and buy based upon a recommendation or price. “If I pay more, then it must be good.”

This pattern usually suggests category polarization.

Heavy users have shifted toward coatings, ceramic and graphene systems, and pro-grade detailing routines. “Wax” as a concept appears to be declining.

At the same time, enthusiast culture has moved toward influencer and boutique brands that sell systems, education, and credibility.

If Meguiar’s remains positioned as a mass generalist rather than a system leader, it may be getting squeezed between cheap and pro.

CMO takeaway: When heavy users grow but your brand declines, the category’s technology and culture may be moving faster than your positioning.

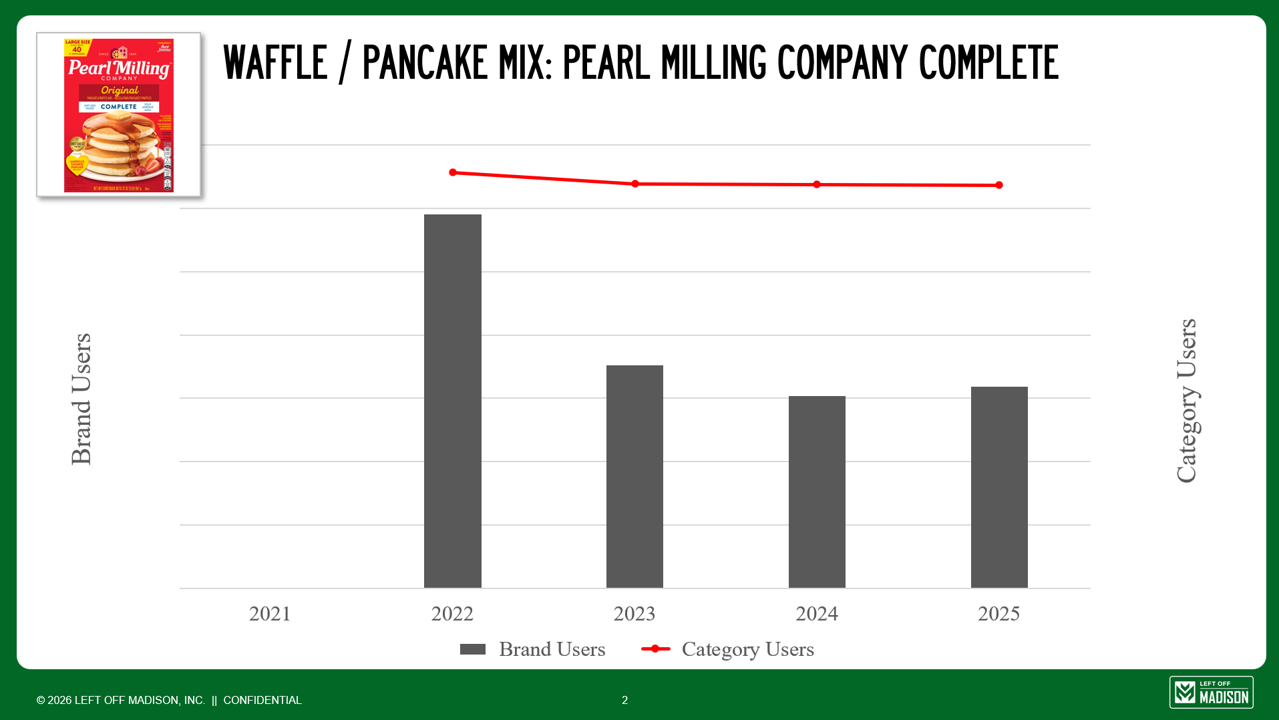

PANCAKE & WAFFLE MIX: PEARL MILLING COMPANY COMPLETE

Pearl users: –46% since 2022

Category users: –3%

Heavy users: +8%

This pattern strongly suggests that the rebrand played a meaningful role.

From a brand science perspective, Aunt Jemima carried a century of memory structures: shelf recognition, habit loops, and heuristic buying. Pearl Milling became unfamiliar overnight — harder to find, lower salience, and more cognitively expensive to identify. (Tongue in cheek, I guess we could say Quaker Oats/Pepsi got woke, but is now putting this brand into a sleeper hold.)

Rebrands almost always cost penetration unless massively supported. If advertising and in-store support lagged the rebrand, that alone could plausibly explain a large portion of the decline.

At the same time, heavy-user growth suggests the category is shifting toward performance and function: protein, whole grain, keto, high-fiber, clean labels. Breakfast is increasingly a daily fuel ritual, not just a weekend treat.

If Pearl “Complete” did not evolve its nutrition story or hero benefit quickly enough, it may have lost exactly the users who are growing.

Distribution and promotion may have softened the volume impact in the short term while penetration eroded underneath.

CMO takeaway: When heavy users grow but your brand collapses, the data often suggests the future of the category is happening somewhere else.

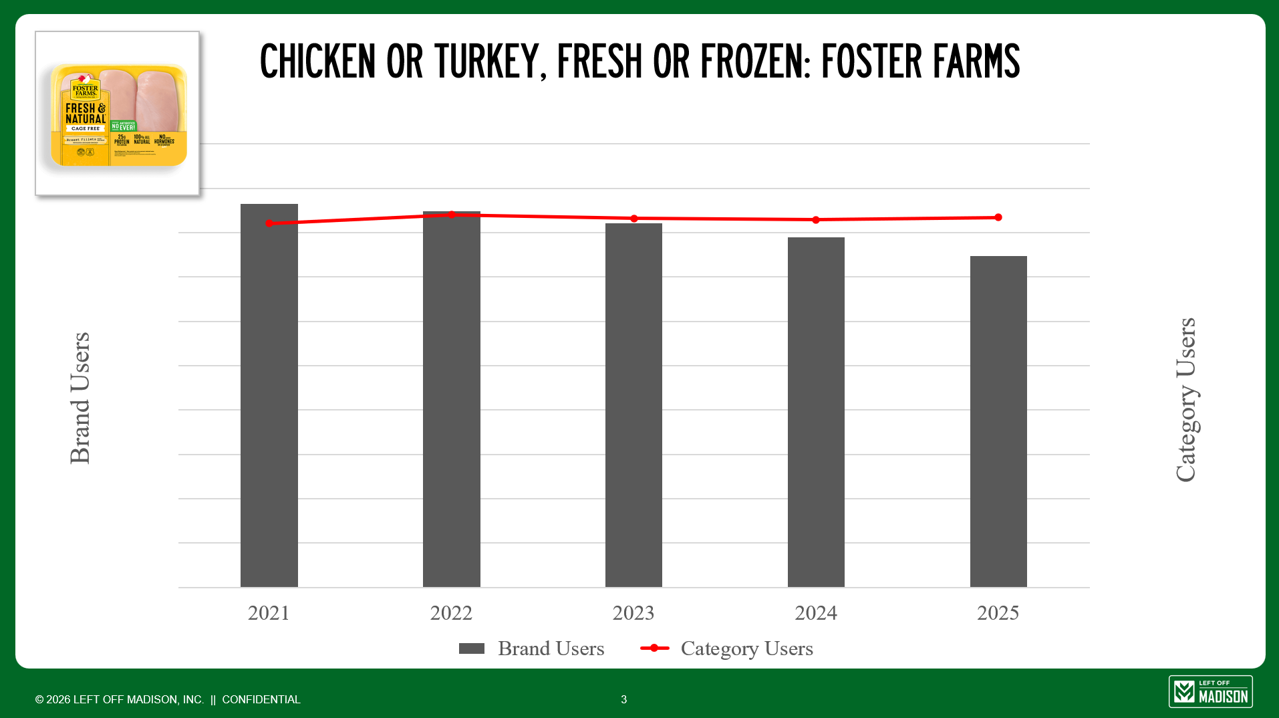

FRESH POULTRY: FOSTER FARMS

Foster users: –14% since 2021

Category users: +2%

Heavy users: +6.7%

Here, both the category and heavy buyers are growing while Foster declines. That typically suggests misalignment with where growth is coming from.

Since 2021, fresh poultry growth has skewed toward premium and ethical cues: antibiotic-free, organic, air-chilled, animal welfare, clean sourcing, and premium private label.

If Foster remains primarily coded as mass and conventional, heavy users may be growing the category by trading up to higher-meaning alternatives.

Channel dynamics likely matter as well. Heavy buyers increasingly shop club and premium private label. Loss of key facings or premium SKUs in those channels can shift growth away from branded suppliers.

Finally, growth has been driven by new formats — meal prep, air fryer cuts, seasoned and ready-to-cook — not just raw commodity cuts.

(As a side-note, ask Boris to share Rob’s crazy idea that was pitched to their former poultry client, who he himself is brave, but not THAT crazy.)

CMO takeaway: When heavy users grow but your brand shrinks, growth may not be missing. It may be happening in a version of the category you don’t own.

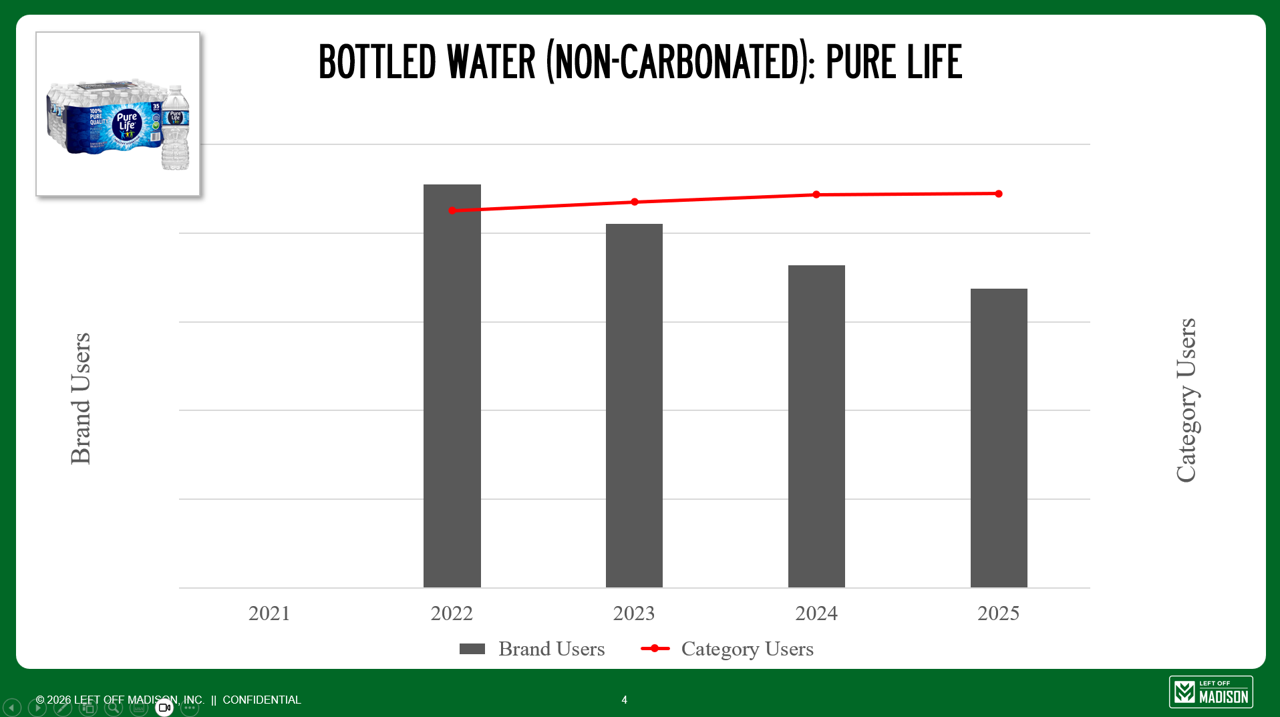

BOTTLED WATER: PURE LIFE

Pure Life users: –26% since 2022

Category users: +4%

Heavy users: +4%

This pattern suggests a loss of relevance in a category that is actively upgrading. (LOL- except those of you who are from, or who have visited, Costa Rica.)

Since 2020, bottled water growth has been driven by premiumization, functional benefits, mineral and alkaline positioning, sustainability, and lifestyle branding.

Heavy users increasingly choose brands that signal purpose, performance, or identity — not “just water.”

If Pure Life remains coded as cheap, mass, plastic, or generic, it may be the first brand abandoned as consumers trade up.

At the same time, private label likely hollowed out the value end. Competing on price in bottled water tends to destroy loyalty quickly.

Advertising alone rarely fixes this without a shift in meaning. Although Rob begs to differ and challenges pundits if the magic of Costa Rica could be woven into the brand identity much like how Tommy Bahama, L.L. Bean, Patagonia, and even (R.I.P) Jimmy Buffet’s Margaritaville sells the vibe of specific destinations.

CMO takeaway: When both category and heavy users grow but your brand loses a quarter of its base, the problem is often not awareness, instead, it’s future relevance.

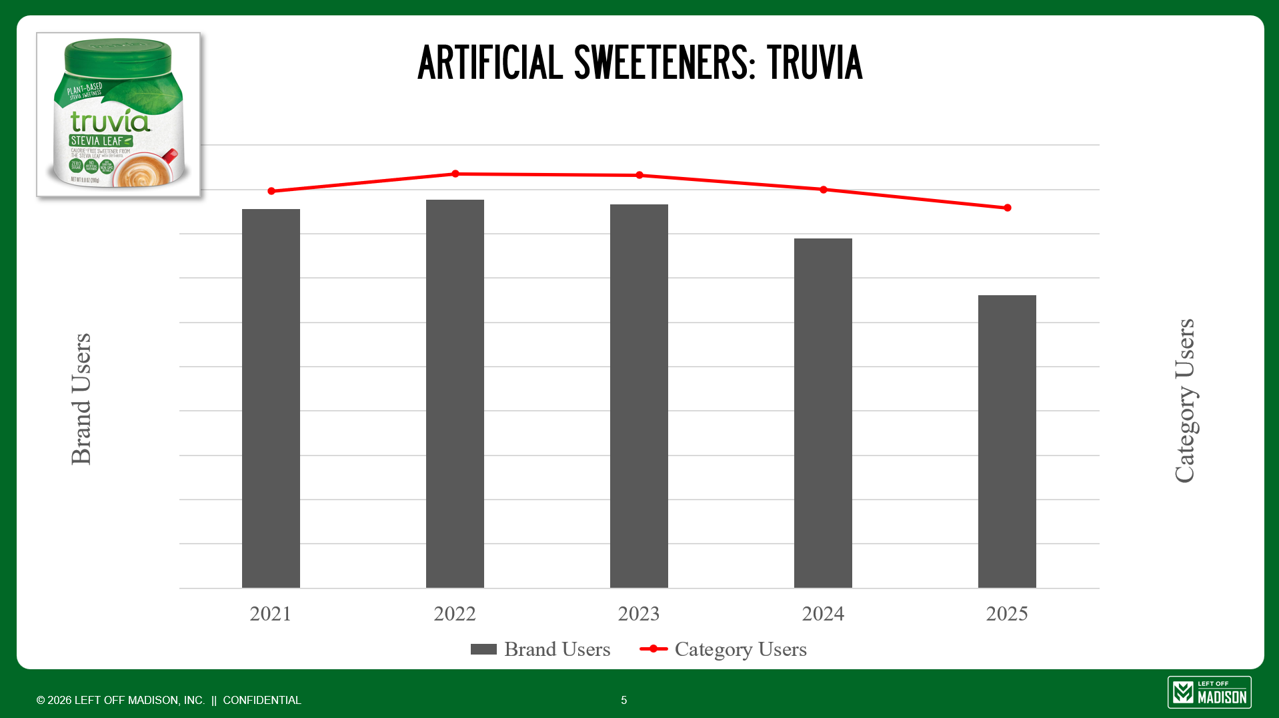

ARTIFICIAL SWEETENERS: TRUVIA

Truvia users: –23% since 2021

Category users: –4%

Heavy users: +0.5%

A 23% decline in Truvia users while the category only slips modestly (and heavy users remain flat-to-up) suggests a very specific dynamic:

Demand may not have disappeared. Truvia may have lost permission. We ask ourselves, “how is this possible?” in the wake of what seems like everyone on drugs like Ozempic and Mounjaro.

In other words, people who still use sweeteners may be choosing other brands, using less Truvia per household, or mentally filing it under “old choice” as the category’s meaning evolves. Several factors could be contributing.

First, Truvia may be on the wrong side of the health narrative shift. The category has moved toward “clean,” “less processed,” and functional benefits. If Truvia is still coded primarily as a “diet sweetener,” it could be losing relevance even if the product remains technically sound.

Second, distribution may have expanded faster than relevance. More facings and more promotion can create the illusion of strength while preference erodes. Price-led defense often trains light users to buy whoever is on deal.

Third, advertising may be present but non-differentiating: same benefits, same rational claims, little new cultural role.

Finally, Truvia may not fully own emerging usage moments — smoothies, better-for-you baking, daily swaps — that drive penetration.

CMO takeaway: When heavy users hold steady but your brand declines sharply, you may not have a demand problem. You may have a preference and permission problem.

WHAT THESE FIVE DECLINES APPEAR TO HAVE IN COMMON

Across five very different categories, three patterns repeatedly appear:

Decline often begins with relevance, not distribution.

Innovation frequently lags category shifts by several years. (Have you been watching Heinz lately?)

Brands often defend with promotion when the problem is belief.

Most brands don’t lose markets. They lose confidence. And by the time revenue shows it, the hardest work is already behind them.

The question isn’t whether decline starts. It’s whether you see it early enough to stop it.

Explore some of our own brand revival case studies, HERE, or some of our brand/product launch case studies, HERE.